Take a look at NerdWallet's selections for a few of the very best personal fundings for home renovations. A HomeStyle home loan allows residence customers and also refinancers to roll the expenses of restorations into the lending. Qualified newbie house purchasers can buy with down payments as low as 3%. If you have the month-to-month income to pay home mortgage prices, yet inadequate cost savings to pay the deposit, you may receive a reduced-interest rate loan of at least $3,000 to assist cover the down payment. You require a minimum of one bid (and in some cases as many as 3) for your repair from qualified experts.

Concerning Money Crashers

Do you need a downpayment for a rehab loan?

Down payment: The minimum down payment for a 203(k) loan is 3.5% if https://troyuyxe542.hatenablog.com/entry/2020/06/07/144718 your credit score is 580 or higher. You'll have to put down 10% if your credit score is between 500 and 579. Down payment assistance may be available through state home buyer programs, and monetary gifts from friends and family are permitted as well.

It's finest to deal with a loan provider that has experience with this car loan program, as well as specialists that have actually collaborated with homeowners that have a 203k funding. This is due to the fact that they are able to handle the added documentation to meet FHA requirements and also to approve the FHA-driven settlement timetable. Requirement 203( k) financings are for houses that do need much more extreme repairs, including structural repairs and also space additions.

Mortgageloan.com is not responsible for the accuracy of Drug and Alcohol Treatment Center details or responsible for the accuracy of the prices, APR or funding info published by brokers, marketers or lending institutions. LTV is the amount of real or implied equity that is available in the collateral being borrowed versus. For home acquisitions, LTV is established by splitting the loan amount by the acquisition cost of the house. Lenders assume that the more money you are setting up (in the form of a down payment), the less likely you are to back-pedal the loan.

That does not mean you can not effectively flip residences, but loan providers may be hesitant to accept you. Traditional loan providers base their financing choices on your ability to settle a finance.

- FHA fundings are exceptional for newbie buyers because, along with reduced ahead of time car loan expenses and also less rigorous credit scores needs, you can make a down payment as reduced as 3.5%.

- Department of Real Estate and also Urban Advancement, gives different home loan programs.

- An FHA lending has reduced down payment demands and also is much easier to receive than a conventional lending.

Typical loan providers choose to provide cash for residential or commercial properties that are in good problem. You may plan to repair those issues, drastically raising the worth of the house for a revenue, yet loan providers are most thinking about providing for houses that are move-in prepared.

How do you qualify for a rehab loan?

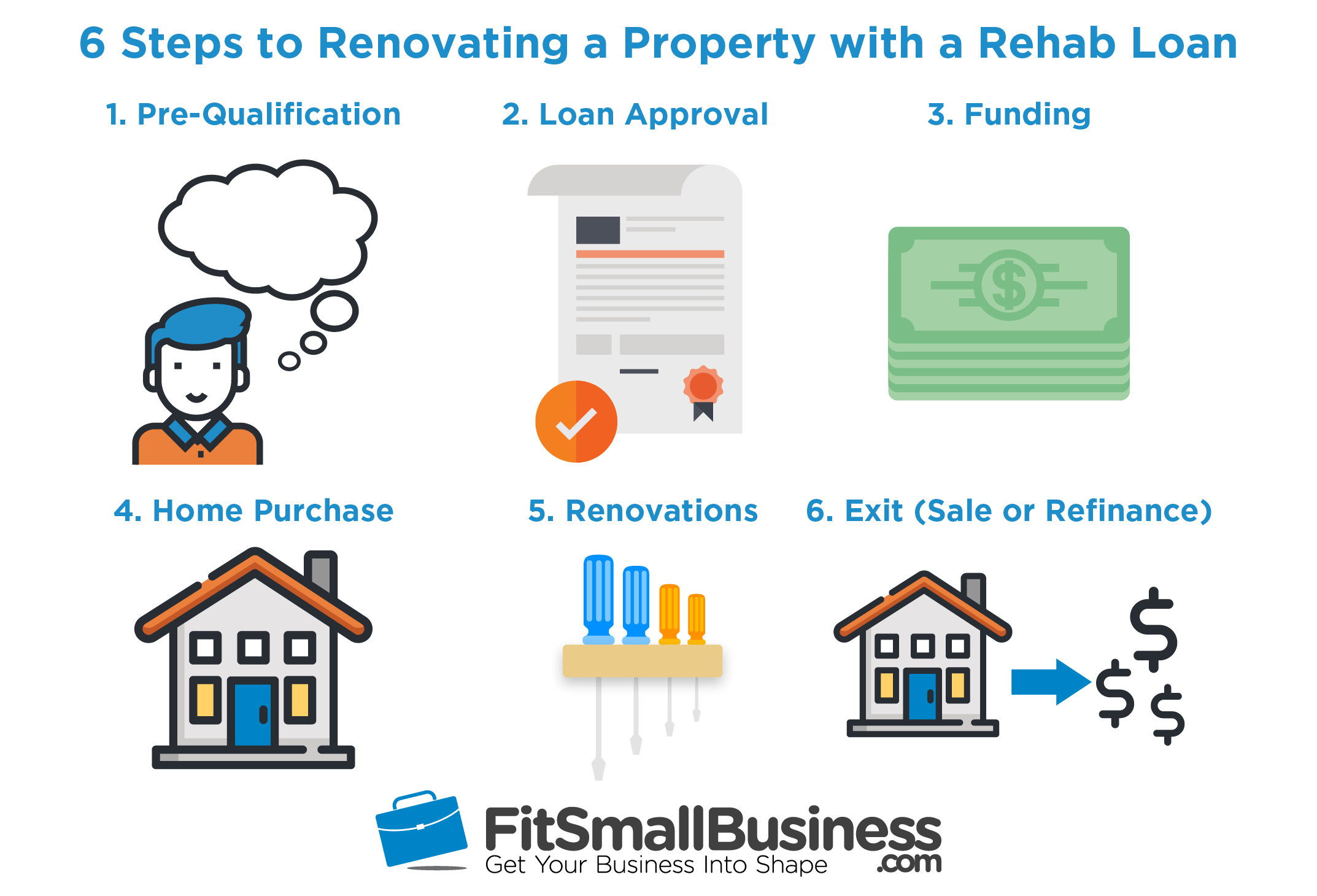

Rehab mortgages are a type of home improvement loans that can be used to purchase a property in need of work -- the most common of which is the FHA 203(k) loan. These let buyers borrow enough money to not only purchase a home, but to cover the repairs and. renovations a fixer-upper property might need.

Traditional car loans are defined as either conforming car loans or non-conforming loans. The 2020 finance restriction for a traditional mortgage is $510,400 overall, though it can be more for designated high-cost areas. The myriad of funding alternatives offered for new homebuyers can seem frustrating. Yet taking the time to look into the basics of residential property financing can save you a considerable amount of time and also cash. Recognizing the marketplace where the property lies and also whether it uses motivations to loan providers may mean additional monetary perks for you.

Money Crashers

Lots of FHA 203k lending institutions will simply flinch at the thought of letting you spruce up that "dream house" yourself. Full a brief kind at this web link, and examine your qualification for a 203k finance from a lending institution in our network.

Lenders will certainly require an evaluation of the property in its current condition and an approximated evaluation of what its worth would certainly be after repair services are made. This protects against debtors from putting even more money into a home than the last worth of Click here to find out more that residential property would support, Hardin said.